Digital Drives Efficiencies, Datacultr Drives Digital

15 Million+

Loans secured

US $4.55 Billion+

Loan value secured

Global Risk Management and Debt Collection Operating System for the

New to Credit

Low- or no-score customers are caught in a vicious cycle: lacking data, credible documentation, and collateralizable assets, this segment struggles to access formal credit. If any credible data were available, financial institutions might have already offered them relevant products. That’s where Datacultr comes in, providing a viable alternative for lenders by using the borrower’s smartphone to help reduce perceived risk.

Additionally, in times of declining right-party contacts and increasing customer adoption of digital technology,

Datacultr is making this segment viable by:

- Bringing down costs

- Driving efficiencies in traditional collection processes

Transformational Impact

First Month Defaults

Non-Performing Loans

Debt Collection Efficiency

Loan Approvals

Drive Credit Decisioning and Repayments

Financial institutions, telecom operators, retail chains, and fintech that provide smartphone financing, such as Buy Now Pay Later, microloans, nano loans, and other unsecured loans, use Datacultr’s innovative digital platform to increase loan approvals among customers in the 0 and -1 credit segments.

Smartphones are essential tools for livelihood and access. In the absence of alternative data, using the borrower’s smartphone as a virtual asset becomes a critical factor in lenders’ decision-making.

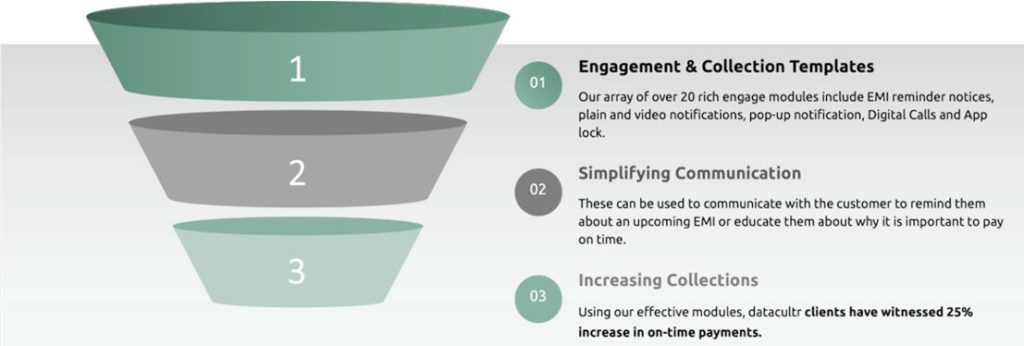

Datacultr’s engagement models and digitized collection processes help ensure payments are not missed, establish positive repayment habits, and influence the borrower’s ‘intention to pay.’

Automate the entire loan lifecycle.

GDPR compliant, ISO 27001-2013 & SOC2-Type 2 certified.

Digital formats that contact the device, not the mobile number.

Carried out at the retail store or by the customer.

Devices Covered

Android

Wifi Tablets

We at Datacultr Empathise Emphasise Educate

Unlock Seamless Solutions with Datacultr: Your All-In-One Platform

Pay via apps, wallets, web, and USSD.

API-Driven for Efficient Lifecycle Automation

Embedded Payments for Seamless Transactions

Pay via apps, wallets, web and USSD

Multiple Layers of Security

With advance offline features